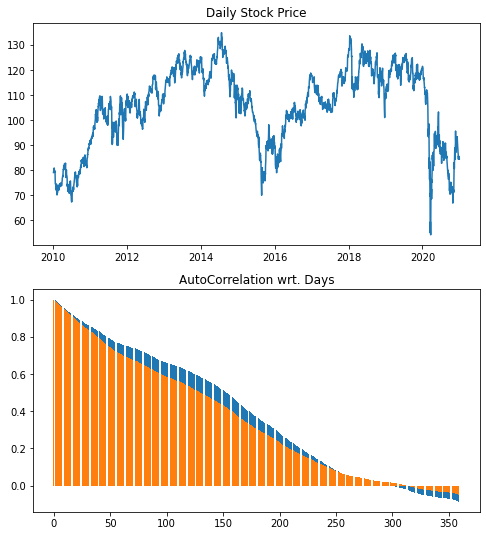

Calculating autocorrelation coefficients for time series stock data

The correlation coefficient between time series data and the data shifted by n steps is called the autocorrelation coefficient.

It is used to check if there is periodicity in the data or not.

You could simply estimate value by own function, or you can use the dedicated function defined in pandas to estimate them.

import numpy as np

import matplotlib.pyplot as plt

import yfinance as yf

data = yf.download('CVX', '2010-1-1', '2021-1-1')['Close']

autocrr_series = [data.autocorr(lag=i) for i in range(360)]

fig = plt.figure(figsize=(8, 8))

ax = fig.add_subplot(211, title="Daily Stock Price")

ax.plot(data.index, data)

ax = fig.add_subplot(212, title="AutoCorrelation wrt. Days")

ax.bar(range(360), autocrr_series)

def autocov(X, N, k, Xs):

autoCov = 0

for i in np.arange(0, N-k):

autoCov += ((X[i+k])-Xs)*(X[i]-Xs)

return (1/(N-1))*autoCov

def autocorr_test(X,k):

N = np.size(X)

Xs = np.average(X)

return autocov(X, N, k, Xs) / autocov(X, N, 0, Xs)

auto_series_manu = [autocorr_test(data, k) for k in range(360)]

ax.bar(range(360), auto_series_manu)

plt.show()